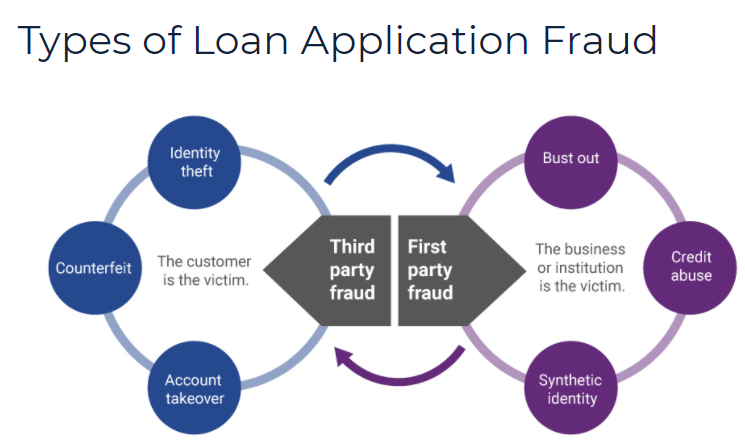

Did you know that in the first four months of 2021 in the US, the digital fraud attempts rose by 25.07% compared to the last four months of 2020? The CNBC reports have confirmed this figure.

Online payday loans are part of digital business services. Therefore, if you are not careful you can end up in the statistics of people who have been scammed.

So, how can you determine the security of a payday loan lender? Research is important.

Tips For Determining a Secure Payday Loan Lender

No Money Requests Before Loan Granting

You should not pay any cent before the online payday loan is awarded to you. The only money you’ll pay is the loan plus the interests and the penalties involved in case of early and late payments.

Since the loans are online, there are no fees involved during the application. If a lender asks for money during the application, you should quickly run away from that site.

Has a Secure Website

A secure website has the following features:

- Has an ‘S’ in the HTTPS URL Address

The ‘S’ in the HTTPS shows that it is safe to transfer sensitive information through that site. If a site has HTTP instead of HTTPS, it may be easier for someone to access the personal information you are sending and use it against you.

- Lock in the Address Bar

The lock in the address bar shows that the site is encrypted. This increases the security of your data meaning no one can access it.

- A Professional Look

Imagine passing through a site that has disarranged images, words are not well spelled and the font color is horrifying. Would you use such a website? Hell no!!

A lending institution is a business type. That means they should devote their time and cash to create a professional-looking website.

The Lender Discloses All the Information Required

You have the right to know the amount you can borrow, the interests involved, whether or not there are prepayment fees, the late payment fees involved and what will happen if you fail to pay in time.

All this information will help you make better decisions concerning the loan. A payday loan lender should not hide any information even if it has a negative impact, for instance, the high interest rates.

The Lender Has a Positive Reputation

A reputable lender is licensed by the state in which they are located. The site should also have a physical address and working contact information making it easier to get in touch with the lender.

Also, the payday lender should have a customer service option where borrowers can turn to in case of any challenges.

Reading the online reviews and checking their site ratings will also help to check their reputability.

Follow the Payday Loan Protocols

What do I mean? You are not eligible to get a new payday loan until you complete paying the first one. You have to remember that a payday loan has high interest.

Imagine another loan being added to your first one with all the interests. You’ll go mad from all the stress involved.

Opt For the Direct Lenders

A direct lender is a lender who offers a payday loan. A broker, on the other hand, is a person who directs you to a lender through a small fee. If you are not sure about the broker’s reputability, you can choose a direct lender.

This will save you the fees involved plus the possibility of being scammed.

Is it Safe to Give Your Personal Information?

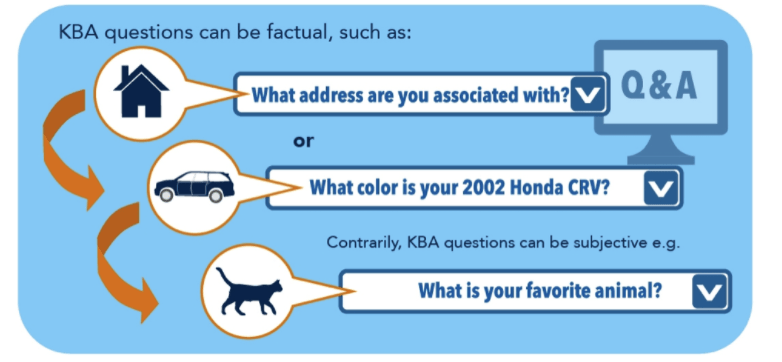

During the application, you will be required to disclose your social security number to help the lender confirm your identity and prevent deception. Also, you will be required to reveal your bank account details for correct money depositing.

But is it safe to do so?

It depends on what site you are working with and the type of loan lender you are dealing with.

Before disclosing any personal information, make sure the site is secured and the lender is reputable. We have already mentioned the security measures for a site and the qualities of a reputable lender.

If a site is secured and has a reputable lender, it will be safe to put your personal information since the data is protected.

How to Apply For a Payday Loan in a Safe Way

- First, check the security of the site.

- Check the requirements needed and make sure you have them during the application. In most cases these requirements include:

- An active checking accounts

- A stable source of income

- National ID

- Active email address and other additional contact information

- Proof of residency

- Social security number

Remember, the requirements vary by different lenders hence some lenders may need additional information. The good thing is that all the information is disclosed on their website.

- Begin the online application

- Submit the application form and wait for a response. The institution offers online payday loans with instant approval from direct lenders hence you may get the loan the same day you applied.

FAQS

1. What can lead to an online payday loan rejection?

If you don’t meet the application requirements, you will automatically be rejected. You can however communicate with the mob loans lender to find a solution to your problems.

2. What questions should I ask when getting a payday loan online?

Some of the essential questions you can ask include:

- What is the maximum loan amount I can borrow?

- What requirements should I have for loan approval?

- How long does it take to get a loan response and the funds?

- Are there fees involved?

- What are the consequences of late payments or default?

- What is the loan term?

These questions can help you get a clear overview of the payday loan.

Payday loans are secure as long as the site is secure and the lender is reputable.